In this article, we are going to learn a very important provision related to designated. So as far as the UAE is concerned in the business there are a lot of free zones especially in Dubai, there are many free zones. So some of the free zones are controlled by customs and entry and exit of humans and the movements of goods are controlled by fencing so those are customs controlled free zones.

Some other free zones in many most of the free zones in the UAE are not customs controlled free zones. So the as per the UAE law, UAE VAT Law adverse the free zones are divided into two

• Designator zones

• Other than designated zones

So there are some special provisions that are applicable only for designated zones. Those are mentioned in article 51 of the execute regulation of the VAT Law before understanding the provisions related to designated zones let us understand how the transactions are there in the mainland. See in my example

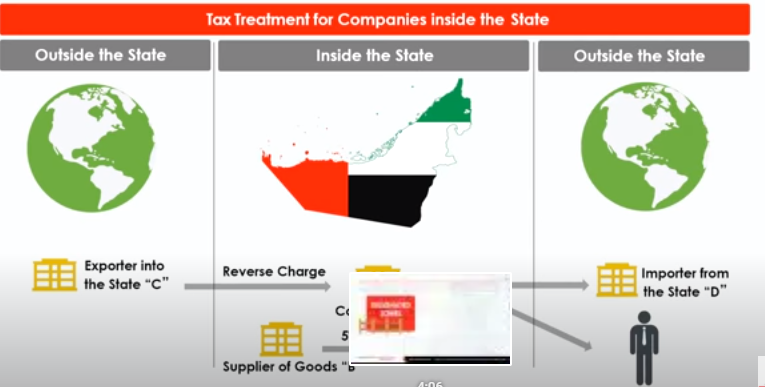

The central position is inside the state that is UAE the left and the right is considered as outside the UAE. So in this example, I am going to discuss when materials are importing from outside the world that is outside UAE - UAE it has to be recorded under the reverse charge that we already discussed.

When we are selling materials from UAE that is in the mainline to our state UAE that is - other than implementing state. It will be an X export that will be 0 rated the same time within the UAE. If the means from within the UAE if any purchases and then the supplier has to charge five percent from the customer

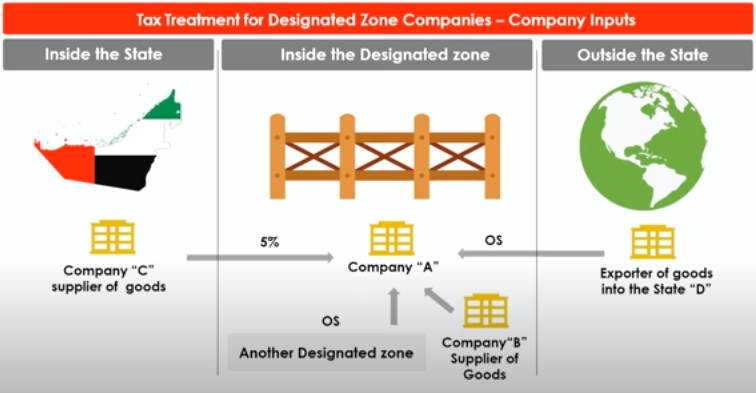

Now let us understand how the tax applicability in the case of designated zones. Let us consider the purchases in the case of goods the purchases. See in my example

The center point is the designated zone and on one side you can see the world outside UAE the other side you can see UAE. So you a designated zone outside UAE let us see how the purchase impact will be there for the vat for the designated zones.

Here the goods are purchased either from the mainland or from the designated zone or from outside the UAE. Suppose the first purchase is happening from outside the state then such purchase will be out of scope. There should not be the tax applicability for such purchases

Second, if the purchase is happening from the mainland that is inside the state from the inside state the designated zone is purchasing some products in that case five percent tax will be applicable. So the buyer that is a designated zone has to account and can take the input credit.

Next one if any sale is happening within the designator zone that means our company is going to buy from a designator zone the discharge supplier, in that case, it will not be taxable because within the designator zone if the materials are sold it will not be taxable unless it is used for consumption. The same way if the purchase is happening from another designated zone also there will not be the tax.

Now let us see while selling the products how the tax will be applicable in the case of designated zones. See the translations the center point is designated zone

So on one side is inside UAE and the other side is outside the UAE so here let us understand how the tax applicable.

See the designated zone I company is registered in the designated zone that is selling the products to another company which is located outside the UAE. in such case it will be out of scope the tax liability will not be there for the designators own company even though the sailors are making to an individual outside the UAE still the tax liability will not be it will be an out of scope sales.

At the same time if the registered company in the designated zone is selling to a mainland company or to an individual overall the tax impact will be 5 percentages. At the same time the designated zone company registered one selling to another company registered in the designated zone, there won't be the tax.

But if such a sale is made to any individual for consumption definitely five percentage of taxes have to tax has to be collected by the designator's own company and a way to the authority. The same time if such a sale is made to another company within the designated zone but if such sale is made for consumption then also five-person a tax has to be collected and paid to the authority

The same will be applicable in the case of another designator zone then a five percent tax will be there if it is used for consumption otherwise no tax or such a sales.

So far we were discussing the transactions of goods from the designated zone to the mainland or designator zone to outside UAE or between designated zones or within the designated zones as well.

But in the case of services or services from the designated zone company will be treated as at par with the state that means for any service done within the designated soul will be treated as similar the transaction taken that means 5% tax liability will be there for transactions for the services done in the designator.

So in short designated zones have got special provisions and some of the transactions will be taxable and some of the transactions will not be taxable in the case of services in the designated zone.